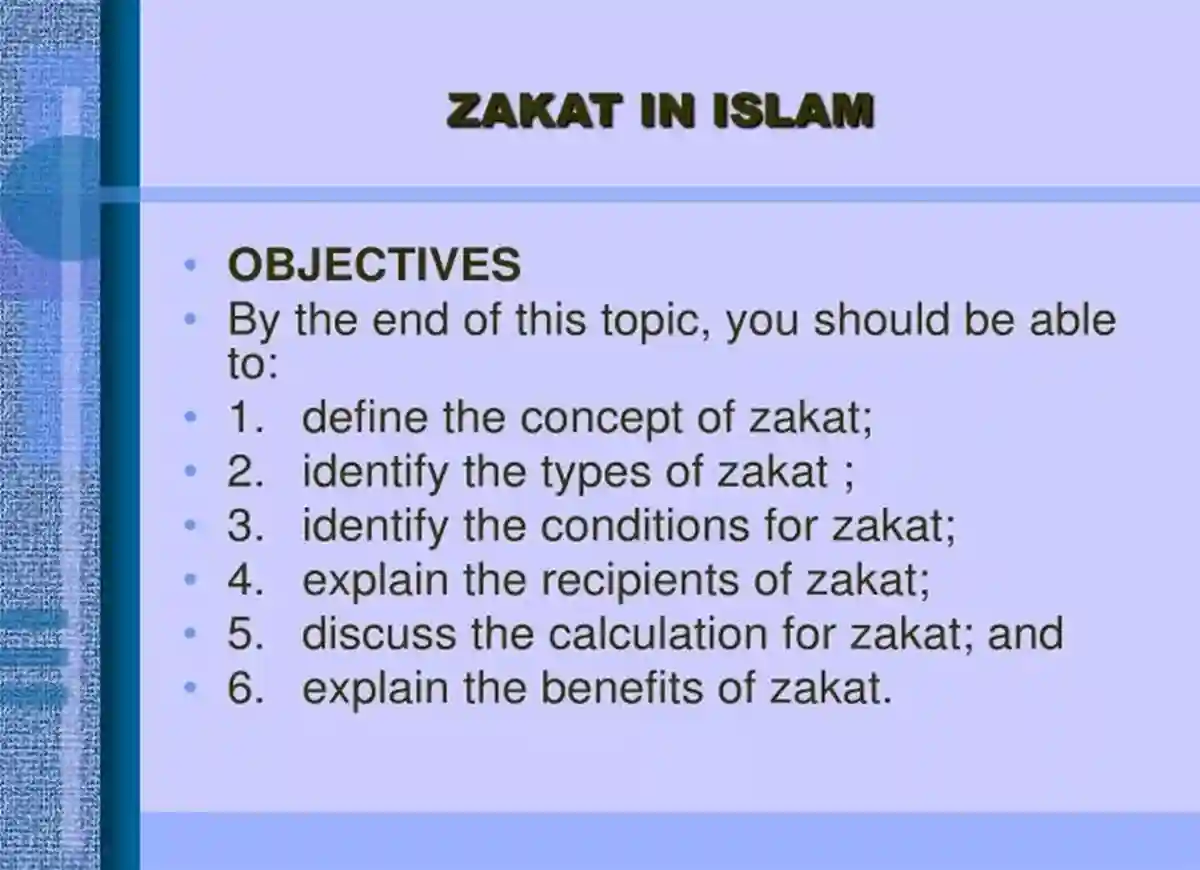

“Delve into the Essence of Zakat – Understanding Its Significance, Legal Implications, and the Far-reaching Benefits it Brings” The literal significance of the literal meaning of “Zakat” is purity. This Islamic technical meaning is the amount of food, wealth properties, food, etc., that a Muslim with sufficient resources must share among legitimate beneficiaries.

Zakat is an extraordinary institution that is a key element of Islam. Allah, Almighty, Says (what is): “And establish the prayer and then pay Zakat (the poor’s due) )…” (Qur’an, 2:43(Qur’an, 2:43)

Additionally, Zakat is an obligatory action as it is one of the five pillars of Islam. The Prophet Sallallahu alaihi sallam (may Allah exalt his mention) declared: “Islam was built upon five (pillars) that include: ‘The proof that no one has the right to be worshipped except Allah and the fact that Muhammad has been appointed the messenger of Allah and the institution of a prayer payment of an obligatory charitable contribution (Zakat) as well as an offering towards the house (Haj towards the Ka’bah of Makkah) in Makkah) and eating fasting (the period of) Ramadan.”‘ Al-Bukhari, and Muslim[Al-Bukhari and Muslim]

Zakat is a small amount of the wealth of Muslims to be distributed to the poor or other specified beneficiaries. If someone asserts that Zakat is not obligatory and refuses to pay, it is not a Muslim; however, a Muslim who does not pay Zakat because of stinginess even though they claim that it is obligatory and committing a serious wrong can be punished severely.

Allah, Almighty, Says (what it means): “…and as to those who have the treasures of silver and gold and don’t spend it for the sake of Allah and Allah, announce to them a gruesome torment. The day that these treasures they have hoarded will be consumed by the Fire of Hell, and with it, they will be branded with foreheads, their thighs, and their backs (and they will hear revealed to them). “This is the wealth you hoarded for yourself. You can now taste the stuff you used to hoard.'” [Qur’an 9 34-35]

Allah, Almighty, also Says (what does it mean?): “And let not people who want to withhold the things that Allah has bestowed upon them from his bounty (wealth) believe that it’s good for them (and therefore they don’t make Zakat). But it’s more harmful to them. The items they have covetously hidden will be tacked to their necks in the form of an eagle on the day of resurrection. Day of Resurrection …” (Qur’an 3:180)

There is no other language for”Zakat. “Zakat” and its meaning. It’s not just a charity, alms-giving tax, or Tithe. Also, it is not simply an act of kindness. It’s all of these and more. It is a requirement imposed by Allah and a source of cleansing for oneself and society.

The Lord Almighty Says (what does it mean?): “Take from their wealth’sadaqah’ (Zakat) to cleanse them and bless the people with it.” Qur’an 9:103(103).

Zakat is beneficial to society in a variety of ways. Here’s an explanation of the wide-ranging effects of Zakat:

1. Zakat cleanses the person and also his wealth. The value of his wealth will be elevated in the eyes of Allah, and, in turn, the person will be rewarded. If a person is liable to pay Zakat and Zakat, a specific proportion of his wealth needs to be distributed as soon as possible in the proper manner, as at this point, the wealth that needs to be distributed doesn’t belong to the person. If the wealth is kept in any way, it ruins the value of his assets.

2. Zakat is not just a means to cleanse its owner of the person who has given it but also cleanses his heart from greed and selfishness. It also cleanses his heart of jealousy and envy and instils in the recipient’s heart goodwill and warm wishes to the donor. This means that society’s wealthy and the less fortunate become one by working together and supporting each other.

3. Zakat reduces the burdens of the poor and needy citizens, but people in need shouldn’t rely entirely on it.

4. Zakat is a proven method to foster a sense of social accountability on the part of the wealthy, as well as the feeling of belonging and security among those less fortunate.

5. Zakat clearly illustrates the religious and human interactions between individuals and society. It’s clear proof of the fact even though Islam does not prohibit private business or denounce private property; it doesn’t condone an unjust and envious control of property and wealth. This reflects the general ideology of Islam, which follows an appropriate and effective path between individuals and society.

In the end, we refer to the call of Allah, Almighty (what means): “O You who believe! Will I help you make an agreement that will spare you from suffering in this world and in the future)? You must believe in Allah and the Messenger of Allah and work hard for Allah’s cause through your possessions and lives. This is for your benefit If you knew it.” Qur’an 61:10-11].

The recipients eligible for Zakat

Allah Almighty classifies the eligible recipients of Zakat into eight categories. Allah Almighty Says (means): “Zakat expenditures are restricted to those who are poor and most in need and for those working to collect [Zakat] and to bring hearts together for Islam and to free enslaved people or captives as well as for people who are in financial trouble and to support the cause to Allah in the case of the stranded travelling affluent and for the stranded traveller – a duty imposed by Allah. And Allah is wise and knowledgeable.” Qur’an 9:60]

The following is the listing of eight categories of qualified people, along with a brief description of each:

1. The Poor:

The poor person needs more money to meet his basic requirements and those of his family members, including food, drinking, clothing, or housing. The term “poor” can be used to describe a person (according to the situation) even if he might have the minimum amount needed for the payment of Zakat (i.e. Nisab).

2. The Needy:

The poor (Miskeen) can be someone whose poverty is higher than that of those who are lower than him. However, their decision is the same for every aspect. People with low incomes and people in need may have decent housing and clothing and still be considered to be disadvantaged and needy even if they don’t have the necessities. In the words of Allah’s Messenger, Allah, sallallaahu ‘alaihi wa sallam (may Allah exalt his mention) described the term “Miskeen” in a few of his narrations as Miskeen in various stories as follows: “The Miskeen is not the person who walks around among the crowd (begging) perhaps receiving some food or two or one or two dates. The Miskeen is the person who doesn’t have enough wealth to satisfy his needs, but the Miskeen does not let anyone be aware of it to receive charity, and is not one to stand and plead with for people.” Al-Bukhari

3. The employees of Zakat (or the people who are associated in its work):

They include they are the Muslims who are hired to take Zakat via pressure or force – on people who are unwilling to donate the amount. They earn their wages through the Zakat collection.

4. Reconciliation of Hearts (Al-Mu’allafati Quloobuhom):

They are the new Muslims who are not convinced, and sometimes, they are influential among their followers. Zakat thus benefits them by easing their souls, building their faith and causing them to adhere to Islam. This is to ensure that there will be a huge benefit obtained from them or that their vices are thwarted.

Zakat could also be offered to non-Muslims in the hope that they might decide to adopt Islam and that families might eventually become Muslims. Therefore, these people receive Zakat to motivate the people they meet to adopt Islam and make it more attractive to them.

5. The enslaved people:

The purpose of this classification is to have Muslims who are enslaved be held in the position of an enslaved person and be freed by Zakat (funds) as well as released (solely for pleasing Allah). This also applies to those Muslims with an agreement to serve as an indentured servile (i.e. there is a contract between him and his employer to be released after paying a certain amount). A person in this situation could receive a gift from Zakat to assist him in fulfilling the agreement and becoming an independent person at the time.

6. The debtors:

A person is owed a debt not acquired through indifference towards Allah or His Messenger sallallaahu the ‘alaihi sallam, and it is impossible to pay the debt. The person in this situation receives the amount that allows the payment of the debt with Zakat. This is because of the words of the Prophet Sallallahu “alaihi” (Sallallahu ‘alaihi) wa sallam: “Begging is not permitted, except for three (3) cases: The person is extremely poor, those with severe debt, or who owes (debt from) blood (money).” (At-Tirmithi as well as Abu Dawood] If one decides to pay Zakat due to him, in the form of paying back debts for another the other person, he must inform him. In the absence of this, it won’t be considered Zakat. Instead, it will be considered a charity, and the donor would have to pay the Zakat due to him.

7. The way of Allah:

It is a payment to pay for Jihad (fighting) to try to increase the power of Allah, The Supreme, and any other thing which aids in this in any way. Therefore, anyone willing to fight the direction of Allah receives (from Zakat), even when he’s wealthy. According to the opinions of Imam Ahmad, Allah may be merciful to his soul; this also applies to helping a person not wealthy enough to do Haj.

8. The wayfarer

He is the one who spends all of his cash outside of his home or city while travelling. This is why he receives Zakat to meet the needs of a stranger regardless of whether he’s an affluent man in his home country. This is because of the deprivation he experiences on his travels and being removed from the resources available to him. This is because only one can provide him the money that would aid him to meet his requirements.

If someone is willing to loan him that he can take, he has the right to accept the loan, but it is not a matter of Zakat when he’s considered a rich man within his country (this is by the Maliki School of Jurisprudence). This is only the case if the journey is for a legitimate reason (i.e. didn’t travel to commit a crime).

General guidelines:

1. If you are a Muslim who gives Zakat from his money to any of the eight types that are (eligible) recipients and are deemed eligible, that’s enough. But, he must prefer those who are the most significant and have the greatest demand.

2. Zakat is not a payment to those whom the Muslim must pay for such as the parents, children, and wife, as he must provide them with money whenever they’re in need.

3. Zakat is only a valid option if it is done when it is done with intention. If one pays without the intention of submitting the obligatory Zakat, the amount is not considered Zakat. This is because of Muhammad, sallallaahu ‘alaihi wa sallam, advising us that the intentions behind them rate acts and that each person will get what they want. [Al-Bukhari]

The person who pays for it should pay it with the intent of paying the due Zakat, which is obligatory for the person paying it. It is also essential to declare his decision to pay in the name of Allah since sincerity is required to accept any action or act of worship.

Article source: http://www.islamweb.net/emainpage/

Morals, as well as Zakat

Prayer is only included within prayers in the Noble Qur’an if it is associated with Zakat. Zakat is the undisputed and akin to prayer found within The Book of Allah The Almighty and the Sunnah for His prophet, sallallaahu ‘alaihi wa sallam.

Zakat is similar to prayer in its connection to morals. The person who pays Zakat makes it available in faith in God and adherence to His rules and warding off evil spirits by avoiding being asked about the requirement for Zakat at the time of Judgment.

Zakat can increase one’s wealth. It lets him help the less fortunate and in need. It also shields him from cruelty and wards off his desire for sin. It promotes an environment of intimacy, love and love between Muslims and helps create a strong connection between the wealthy and the poor in the Muslim community.

The person who pays Zakah is awed by the pleasure and happiness of the heart as he abides by the instructions of Allah The Most High. So, he is determined not to topay the required Zakat and is dedicated to distributing it to suitable recipients. Allah the Exalted Words (what does it mean) [Qur’an 9:103]

If Muslims realize the importance of this, they become ready to pay the required Zakat and tithe and give back to charity by their capabilities, even if it is not a requirement for them. They are then enthusiastic to donate money and assist others in every way possible. It demonstrates the integrity of their hearts as well as the spiritual apex of their souls.

A Messenger from Allah, sallallaahu ‘alaihi wa sallam, said: “Smiling in the face of your fellow man is charity. Encouraging good behaviour and not allowing evil to happen is charity. Guiding an abandoned person in a foreign country is charity, helping blind people to charity. Eliminating harmful things like thorns and bone roads is regarded as charity. Pouring what’s leftover in your vessel to the one of your brother’s.”

Therefore, the close connection between Zakat and morals within Islam is evident.

ZAKAT:

- Zakah | Zakat al Mal | Zakat – Learn Islam

- Zakat ul Fitr | Muslim Charity – Learn Islam

- Beneficiaries of Zakat | Islamic Relief Worldwide

- Importance and The Significance of Zakat in Islam

- Zakat Facts | Importance of Zakat | Benefits of Zakat

- Zakat al Fitr: The Obligatory Eid Gift to Be Made Before The End of Ramadan

Categories: PRAYER (Salat), ALMS (Zakat), SAWN (Fasting) HAJJ (Pilgrimage) & DUA (Supplications), Hadith and Tafseer, The Holy Quran, Quran Jaz 1- 114

Topics: Ushr and Zakat, Hijab, Arabic Corner, Faith, Islamic History, Biography, Sirat ul Nabi PBUH, Islamic Studies, Halal & Haram