Is mortgage haram? When it comes to mortgages, there are plenty of extraordinary critiques accessible. Some human beings accept as true with that they may be haram (forbidden), even as others trust that they may be permissible. So, what is the fact? Make certain to study until the give up to understand solutions in your queries!

Table of Contents

- What is Haram?

- What is Mortgage?

- Advantages of a mortgage encompass:

- Disadvantages of a mortgage include:

- Is Mortgage Haram or Halal?

- FAQ

- Can I buy a residence with out a mortgage in Islam?

- What is Islamic home financing?

- What are the situations for a Shariah-compliant mortgage?

- Conclusion

What is Haram?

There are many stuff which can be taken into consideration haram, or forbidden, in Islam. Some of this stuff are apparent, inclusive of murder and stealing. Others might not be so straight forward. For example, many humans believe that playing is haram. This is due to the fact it is able to result in human beings becoming addicted and losing money that they can not afford to lose.

There also are many things which might be taken into consideration haram in phrases of private behavior. For example, it’s miles taken into consideration haram to lie or to cheat. This is due to the fact these behaviors can lead to humans being harm or taken gain of.

It is likewise taken into consideration haram to interact in any form of physical violence. This consists of hitting, kicking, or another sort of physical attack. This is because physical violence can result in critical injury or even loss of life.

Finally, it’s miles taken into consideration haram to eat alcohol or drugs. This is due to the fact those substances can cause dependency and fitness problems.

All of these things are taken into consideration haram because they can have a terrible effect at the man or woman and on society as a whole. Islam teaches that we have to stay our lives in a way that is wonderful and useful to ourselves and to others. This means heading off whatever that might purpose damage.

What is Mortgage?

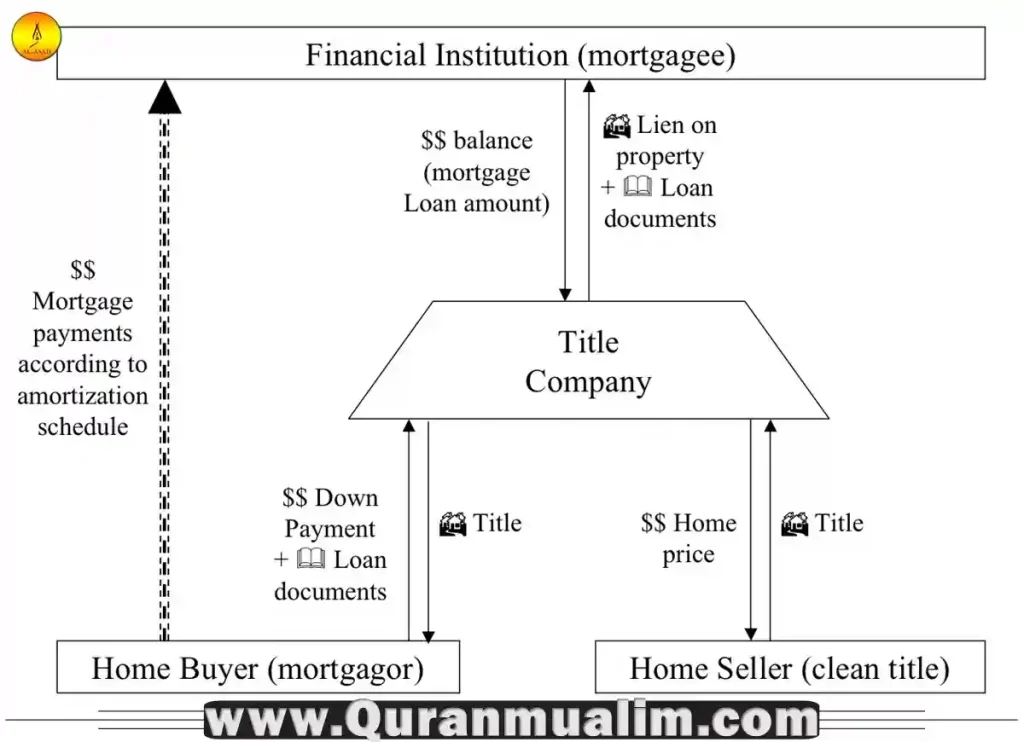

A mortgage is a loan taken out to buy a property, where the property acts as collateral for the mortgage. The borrower (mortgagor) makes ordinary payments to the lender (mortgagee) over a fixed period, commonly 15 to 30 years, till the mortgage is absolutely paid off.

Advantages of a mortgage encompass:

- Allows individuals to purchase a assets while not having to pay the total amount prematurely

- Provides stability and predictability in monthly housing costs

- Homeownership can provide a feel of delight and fulfillment

- Home values frequently appreciate over time, imparting a potential source of equity

Disadvantages of a mortgage include:

- Interest fees over the existence of the loan can add notably to the overall cost of the house

- Failure to make bills can result in foreclosures and loss of the belongings

- Monthly bills can be too excessive for a few borrowers, restricting their ability to have the funds for different charges

- Property values may also lower, ensuing in much less potential fairness or even negative equity.

Is Mortgage Haram or Halal?

There is a good deal debate surrounding the issue of whether or not or no longer mortgage is haram. Some human beings consider that any form of mortgage that involves interest is robotically haram, even as others argue that certain styles of Muslim-specific mortgages can be permissible. Ultimately, it’s miles as much as the person to determine based totally on their own non secular ideals.

If you’re thinking about removing a mortgage, it’s miles vital to do your studies and communicate with a spiritual chief to get steerage on what’s right for you. There are many special opinion on this topic, so it is essential to make an informed choice before shifting ahead. Ultimately, it is as much as you to decide what is excellent for you and your family.

Source Reference – The above information is proven via Islamic Finance Guru.

Guidelines To Own A Home In An Islamic Way

If you need to very own a home in an Islamic manner, here are some alternatives that you could remember:

Save Up and Pay in Cash: This is the most effective way to purchase a domestic without involving any sort of interest or riba. If you could store sufficient money over time, then you may use that financial savings to buy the house right now.

Look For Islamic Mortgage Options: Some Islamic banks and creditors provide mortgage alternatives that comply with ideas based totally on Islamic law. These include Murabaha, Musharaka, and Ijara contracts.

1. Murabaha: In this form of settlement, the lender buys the belongings at the borrower’s behalf and sells it to him at a earnings. In this method, the lender gets a earnings, and the borrower can pay a set quantity as an installment each month or year, which doesn’t contain hobby.

2. Musharaka: This is a partnership settlement among the lender and the borrower. Property possession is shared between them, and income are divided based totally at the agreement.

3. Ijara: It is a leasing arrangement wherein the lender buys the property and leases it to the borrower for an agreed length. The hire paid is used to repay the installments for the acquisition rate.

This way, you may’t destroy the Islamic laws and still own your property. However, in case you’re smart, we suggest heading off such financing alternatives as they’ll be highly-priced due to less competition on this market and better hazard.

FAQ

Can I buy a house without a mortgage in Islam?

Yes, there are alternative approaches to buy a house in Islam without a traditional loan. For instance, you may keep in mind alternatives inclusive of an Islamic domestic financing or hire-to-own agreements that are based in a Shariah-compliant way.

What is Islamic home financing?

Islamic domestic financing is a kind of domestic financing this is established in a Shariah-compliant way, with out involving interest (riba). Instead, the financing is based totally on an equity partnership, where the financier and the client percentage possession of the belongings, and the financier’s profit is primarily based on the rental income received from the customer’s part of the belongings.

What are the conditions for a Shariah-compliant loan?

The situations for a Shariah-compliant loan include fending off hobby-based loans, ensuring that the transaction is primarily based on an equitable partnership among the financier and the customer, and making sure that the transaction complies with the concepts of Shariah law. It is critical to visit a certified Islamic student or professional in Islamic finance to ensure that the transaction is structured in a Shariah-compliant manner.

Conclusion

There is not any definitive answer on whether loan is haram or halal. It depends on interpretation and personal opinion. Some human beings keep in mind loan to be haram because it entails interest, whilst others argue that it’s miles permissible if the loan is from a Muslim-unique financial institution or institution. Ultimately, it’s far up to the man or woman to make the choice on whether mortgage is proper for them. Thanks for analyzing!

Written By Alasd online Quran Tutor

QuranMualim is an Islamic scholar, writer and External Consultant at Renewable Energy Maldives. He writes on Islamic finance, food and halal dietary suggestions. He is a reputable voice in the Muslim network, known for his clean causes of complicated religious principles. He has been invited to speak at diverse meetings and seminars on subjects related to Islamic finance, food and Renewable Energy.

Click Here To Find Out:

- Are Fake Nails Haram?

- Is It Haram to Dye Your Hair?

- Are Lip Fillers Haram in Islam?

- Is CBD Halal? Quick Guide 2023

- Why Are Lash Extensions Haram?

- Are Anklets Haram? Updates 2023

- Are Hair Extensions Haram in Islam?

- Are Zodiac Signs Haram? Quick Facts

- Is Botox Haram In Islam? Quick Guide

- Best Halal Nail Polish Collections 2023

- Do Muslim Women Shave? Quick Facts

- Are Nose Jobs Haram? Quick Facts 2023

- Are Tampons Haram in Islam? Facts 2023