How to Calculate Zakat- THE PAYMENT OF ZAKAH

Conditions of the payment of Zakah-How to Calculate Zakat

There are two conditions for the payment of Zakah to become valid:

- Niyyat [intention]

- Making the Zakah-deserving person its owner

It is stated in Al-Ashbah-wan-Nazaair: The payment of Zakah is not valid without intention. (Al-Ashbah Wan-Nasha’irah, pp. 19) Niyyat means that if the Zakah-giving person is asked [about the payment], he is able to tell instantly without hesitation that it is Zakah.

Forgetting to make intention while giving Zakah

How to Calculate Zakat- If that wealth is given as Zakah which had already been separated with the intention of Zakah, the payment of Zakah is valid even if while giving, one does not remember [that he is giving] Zakah. If this is not the case, the Zakah-giving person can make the intention of Zakah as long as [that wealth] is in the possession of the needy person. If he also does not have it, the intention cannot be made now; the wealth given will be Nafl-Sadaqah.

It is stated in Durr-eMukhtar: It is necessary for the payment of Zakah to become valid that the intention is Muttasil [i.e. present] at the time of payment, whether this Ittisaal [being present] is Hukmi, for example, someone pays Zakah without making the intention but makes intention while that amount of wealth is still in the possession of the Faqeer, or he makes intention while separating the total or some amount of wealth for Zakah. (Durr-e-Mukhtar, vol. 3, pp. 222 – 224)

The words of Zakah

How to Calculate Zakat- It is not necessary to say the words of Zakah while paying it; just having the intention in the heart is sufficient, even if the person says something else. It is stated in Fatawa Shaami: There is no significance of mentioning the term [of Zakah]. Even if someone states Zakah to be Hibah [a present], gift or debt, his Zakah will be regarded as paid according to the most authentic opinion. (Radd-ul-Muhtar, vol. 3, pp. 222)

Delaying the payment of Zakah

It is Wajib to pay Zakah immediately once it becomes Fard and it is a sin to delay its payment without any Shar’i reason. (Fatawa-e-Hindiyyah, pp. 170)

Should Zakah be given at one go or little by little?

If Zakah is paid in advance before the completion of the year, both methods are correct whether one gives it little by little or at one go. However, if Zakah becomes Fard upon completion of the year, it is Wajib to pay it immediately; a person will become a sinner on delaying its payment. Therefore, it is now necessary to give Zakah at one go. (Fatawa-e-Razawiyyah, vol. 10, pp. 75)

After the completion of the year, give Zakah at one go because giving it little by little may also cause other types of harm besides making a person sinner. For example, it is possible that such person departs this life while carrying the burden of not paying Zakah on his shoulders, or he may not have wealth [in the future] for paying Zakah. It is also possible that the person may not have the same firm intention of paying Zakah in the future that he has at present because Satan circulates in a human like blood.

The intention may have changed!

Sayyiduna Imam Muhammad Baaqir had a beautiful coat stitched. He entered the bathroom where he had a thought to give the coat in the way of Allah. He called his servant immediately who came near the wall. He gave the blessed coat [to the servant and ordered him] to go and give it to a certain needy person. When he came outside, the servant humbly asked: ‘What was the reason for such great haste?’ He responded:

There was a possibility that my intention might have changed while I came out.’ (Fatawa-e-Razawiyyah, vol. 10, pp. 84) ! It demonstrates the cautiousness of those people who were purely righteous and ascetic, and were brought up by the greatly pious people. May Allah give us the privilege of following in their footsteps.

Will the responsibility be fulfilled by separating the amount of Zakah?

The responsibility [of paying Zakah] will not be fulfilled by merely separating Zakah. In fact, it will be fulfilled by delivering it to the Fuqara [Shari’ah-declared poor people]. (Durr-e-Mukhtar, vol. 3, pp. 222 -224)

Giving Zakah in Ramadan-ul-Mubarak

How to Calculate Zakat- Once the year [of Zakah] completes, it is Wajib to pay Zakah immediately and delaying it is a sin; no matter whichever month it may be. If someone wishes to pay the Zakah in advance before the completion of the year, it is better to pay it in Ramadan-ulMubarak. In this month, the Sawab [reward] of Nafl is equal to the Sawab of Fard and Sawab of Fard is equal to the Sawab of seventy Fard. (Fatawa-e-Razawiyyah, vol. 10, pp. 183)

Openly or secretly

It is better to give Zakah openly provided that there is no risk of pretentiousness, so that others are persuaded and also, they do not have evil presumption about this person that he does not give Zakah. However, there is no harm in giving it secretly as well. In fact, if the Zakah-receiving person is such a self-respecting person that he will feel disgrace by taking it openly, it is better to give him secretly. (Fatawa-e-Razawiyyah, vol. 10, pp. 158; Fatawa-e-Hindiyyah, vol. 1, pp. 171)

Expressing favour after giving Zakah

How to Calculate Zakat- One should not hurt someone by expressing favour after giving Zakah as insulting someone in this way deprives him of Sawab.

Do not invalidate your charity by boasting of favours and by causing anguish [Translation of Quran (Kanz-ul-Iman)](Part 3, Surah Al- Baqarah, Ayah 264)

Making the intention of Zakah after giving charity for the whole year

After giving charity for the whole year, one cannot consider it as Zakah because it is a necessary condition [to have the] intention of Zakah while giving Zakah or while separating the wealth for Zakah. (Bahar-e-Shari’at, vol. 1, Part. 5, Mas’ala No 54, pp. 886)

However, if the wealth given as charity is still in the possession of the Faqeer and has not been used up or destroyed, the giver can make the intention of Zakah. (Fatawa-e-Razawiyyah, vol. 10, pp. 161)

What if someone dies before giving Zakah?

How to Calculate Zakat– If someone separates the wealth with the intention of the payment of Zakah and then he passes away, this wealth will be included in his estate and the laws of inheritance will be applicable to it. (Durr-e-Mukhtar Wa-Radd-ul-Muhtar, vol. 3, pp. 225)

Is it necessary that the Zakah-receiving person knows about it?

Zakah will be regarded as paid, even if the Zakah-receiving person does not know about it because it is not necessary that he knows that it is Zakah. Instead, the intention of the Zakah-giving person will be considered. It is stated in Ghamz-ul-Uyoon: The intention of the Zakah-giving person is considered, not the knowing [of this fact] by the person to whom Zakah is being given. (Ghamz ‘Uyoon-ul-Basa’ir, vol. 1, pp. 447)

Knowing the amount of Zakah for the validity of its payment

How to Calculate Zakat- For the validity of the payment of Zakah, it is not one of the conditions to know the correct amount that is Wajib. Therefore, Zakah will be regarded as paid. (Fatawa-e-Razawiyyah, vol. 10, pp. 126)

Giving Zakah as loan

How to Calculate Zakat- Zakah will be regarded as paid if it is given to someone by stating it to be a loan. Afterwards, considering that Zakah to be really a loan, if that person comes to return it, the Zakah-giving person cannot take it back, even if he is a needy person himself at that time because Zakah cannot be taken back once it is given. The Beloved Rasool ٖ has stated: ‘After giving Sadaqah [charity], do not take it back.’ (Sahih Bukhari, vol. 1, pp. 502, Hadees 1489) (Fatawa-e-Amjadiyyah, Part. 1, pp. 389)

Giving Zakah to a small child

How to Calculate Zakat- For making someone an owner, it is a condition that the taker [of Zakah] should be sensible and mature enough who knows about possession and does not get cheated. Therefore, if Zakah is given to a small child who knows about possession and does not throw it away, Zakah will be regarded as paid, otherwise not; or the child’s father, Wali ( Wali is a person specified by Shari’ah whose decision is enforced on someone, whether he accepts it willingly or not. (Bahar-e-Shari’at, vol. 2, part 7, pp. 42)), any relative, etc.

Should be present with him who takes possession of it on his behalf. In this case also, Zakah will be regarded as paid, and that child will be its owner. (Durr-e-Mukhtar Wa-Radd-ul-Muhtar, vol. 3, pp. 204)

Remitting a house rent with the intention of Zakah

How to Calculate Zakat- If a person rents out a house and remits the rent, Zakah will not be regarded as paid because for the payment of Zakah, it is a condition to make [someone] the owner of the Maal [i.e. amount] of Zakah whereas in this case, the tenant has been made the owner of the benefit of residence only, not of the Maal [i.e. amount of Zakah].

However, if the tenant is deserving of Zakah, give him the amount of Zakah with the intention of Zakah and make him its owner, then receive it as rent; Zakah will be regarded as paid. (Bahr-ur-Raiq, vol. 2, pp. 353)

Forgiving debt

Zakah will not be regarded as paid if a person forgives someone’s debt and makes the intention of Zakah. (Radd-ul-Muhtar, vol. 3, pp. 226)

Including a forgiven debt for Zakah

If a person forgives someone’s debt, will the forgiven amount also be included in the Nisab or not?

There are its two cases:

- If a person forgives the debt of a Ghani [i.e. Shari’ah-declared wealthy person], he will have to give the Zakah of this [forgiven] amount as well.

- If a person forgives the debt of a Shar’i Faqeer, the Zakah of that particular amount will stand remitted. (Radd-ul-Muhtar, vol. 3, pp. 226)

Paying someone’s debt as Zakah

How to Calculate Zakat- If a person pays someone’s debt without obtaining his permission, Zakah will not be regarded as paid. For this purpose, it is better to give this amount of money to that person with the intention of Zakah. Thereafter, he may pay his debt if he wishes or spend it for any other purpose. (Fatawa-e-Razawiyyah, vol. 10, pp. 74)

Ruling on giving clothes to orphans

Clothes can be prepared and given to orphans from the amount of Zakah, provided that they are made the owner of those clothes and they are also deserving of Zakah. (Fatawa-e-Fayz-e-Rasool, vol. 1, pp. 495)

Purchasing books from the amount of Zakah

How to Calculate Zakat- Books can be purchased and given from the amount of Zakah provided that the takers are deserving of Zakah and they are made the owners; otherwise, Zakah will not be regarded as paid. (Fatawa-e- Amjadiyyah, vol. 1, pp. 372)

What if religious books are got printed with the amount of Zakah and distributed?

There is no doubt that getting religious books printed is an act of great Sawab-e-Jariyah [reward that keeps on increasing] but for this purpose, first make any person who is deserving of Zakah such as a Faqeer its owner, then he may give it for printing the books. (Fatawa-e-Razawiyyah, vol. 10, pp. 256)

Keeping the amount of Zakah in a box of sweets

How to Calculate Zakat- Suppose an amount of money is given to someone as Zakah by keeping it in a bag of flour, a box of sweets, etc. If the giver makes the Faqeer the owner of both, the amount of money and flour or sweets, and the Faqeer also takes possession of the bag of flour, Zakah will be considered as paid even if the Faqeer does not know about the amount of money present in the bag or box because for possession, it is not a condition to know about those things being taken into possession. (Fatawa-e-Amjadiyyah, vol. 1, pp. 374)

Impermissible Heelah of taking the amount of Zakah back

After giving someone an amount of money as Zakah by keeping it in a bag of flour, box of sweets, etc., if the giver purchases the same bag or box at a certain price, that amount of money is Haraam for this person because the Faqeer has sold only the bag of flour or box of sweets, not the money. (Fatawa-e-Amjadiyyah, vol. 1, pp. 374)

Paying the fees of a lawyer – How to Calculate Zakat

How to Calculate Zakat- The amount of Zakah cannot be given as fees to the lawyer of a poor person because making someone the owner is a condition for Zakah. If that poor person is deserving of Zakah, Zakah should be given to him first; then he may pay the fees of the lawyer if he wishes or spend it for any other purpose. (Fatawa-e-Amjadiyyah, vol. 10, pp. 291)

Giving Zakah as a gift

How to Calculate Zakat- On marriage or any other occasion, if someone wishes to make the intention of Zakah for giving clothes or gifts, these can be given with the intention of Zakah if the taker is deserving of Zakah; Zakah will be considered as paid. (Fatawa-e-Amjadiyyah, vol. 1, pp. 387)

Purchasing grain with the amount of Zakah and distributing it

How to Calculate Zakat– If a person distributes food after cooking it or grain after purchasing it amongst the poor and makes them the owner while giving it to them, Zakah will be considered as paid. However, the cost of cooking the food will not be included in Zakah; instead, the market price of the cooked food will be considered as Zakah. Moreover, if the food is only served like a feast, Zakah will not be considered as paid because of not making an owner. (Fatawa-e-Razawiyyah, vol. 10, pp. 262)

What if a person sells grain at a discounted price to the needy and makes the intention of Zakah?

How to Calculate Zakat- If a person purchases grain and sells it to the people who are deserving of Zakah at a discounted price and considers the amount that is decreased to be Zakah, Zakah will not be considered as paid because this is a form of discount, [the condition of] making an owner is missing here. Instead, the person should sell the grain to Aaqil [sane] and Baligh ( Person who has reached puberty.)

people who are deserving of Zakah at the original price, for example, Rs 50/kg. He should first give the amount of money he intends to reduce as a discount, for example 5 rupees as Zakah out of his own pocket and after the taker takes its possession, this amount may be received as the price. In this way, Rs 5/kg have been paid as Zakah; add this amount and include it in Zakah. (Fatawa-e-Razawiyyah, vol. 10, pp. 72)

Being doubtful about paying Zakah

How to Calculate Zakat- A person should pay Zakah if he is doubtful that whether he has [already] paid Zakah or not. (Radd-ul-Muhtar, vol. 3, pp. 228)

Giving less amount of Zakah unknowingly

How to Calculate Zakat- If a person unknowingly pays less amount of Zakah, the amount of Zakah given will be considered as paid because for the payment of Zakah, [having] intention is a necessary condition but knowing the correct amount of Zakah is not a condition. However, this person will become a sinner because it is a sin to delay the payment of Zakah. He should repent and pay the remaining amount of Zakah after making calculation. (Fatawa-e-Razawiyyah, vol. 10, pp. 126)

Making a Wakeel for paying Zakah

How to Calculate Zakat- It is permissible to make someone a Wakeel [representative] for the payment of Zakah. (Radd-ul-Muhtar, vol. 3, pp. 224)

Should the Wakeel know about Zakah?

It is not necessary to tell the Wakeel about Zakah. If a person has the intention of Zakah in his heart and tells the Wakeel that it is Nafl-Sadaqah ( Non-obligatory charity), any other form of charity, Eidi (Money given as a gift on the occasion of Eid in some Eastern countries), or a loan, and asks him to give it to a certain person; even then, Wakalat [making representative] is valid. However, it is better to tell him so that he can take into account the conditions of payment [of Zakah]. (Radd-ul-Muhtar, vol. 3, pp. 223)

Should the Wakeel also make the intention of Zakah?

How to Calculate Zakat- If the owner [of the wealth] gives it to the Wakeel with the intention of paying Zakah, there is no need for the Wakeel to make the intention again because the intention of the owner is present. (Durr-e-Mukhtar, vol. 3, pp. 222)

Making the intention of Zakah after making a Wakeel for Nafl-Sadaqah

If a person says to the Wakeel while giving [him an amount] that it is Nafl-Sadaqah or Kaffarah [expiation] but he makes the intention of Zakah before the Wakeel gives it to the Faqeer, it will be considered as Zakah even if the Wakeel has given it to the Faqeer with the intention of Nafl or Kaffarah. (Durr-e-Mukhtar Wa- Radd-ul-Muhtar, vol. 3, pp. 223)

Mixing the amount of Zakah of different people

How to Calculate Zakat- If the Zakah-giving people explicitly give permission for mixing [Zakah] or if it is Urf [usual practice] to do so and the Zakah-giving people are aware of this Urf, then the Wakeel can mix the amount of Zakah of different people together, otherwise not. (Durr-e-Mukhtar, vol. 3, pp. 223)

Can the Wakeel make someone else a Wakeel?

A Wakeel can also make someone else a Wakeel. (Al-Marja’-us-Sabiq, pp. 224)

Can the Wakeel give Zakah to anyone?

How to Calculate Zakat- If the Zakah-giving people give permission unconditionally that the Wakeel may give it to any Masraf-e-Zakah [person of any Zakahdeserving category] he wishes, he may give it to anyone according to his wish. If the Zakah-giving people ask him to give it to any specific Masraf, he will have to give it only to that particular Masraf. It is stated in Fatawa Shami: If the Zakah-giving person states to give the amount of Zakah to a certain person, the Wakeel does not have the authority to give the amount of Zakah to anyone else other than that specific person. (Al-Marja’-us-Sabiq)

Can the Wakeel keep the amount of Zakah himself?

If the Zakah-giving people give permission unconditionally that the Wakeel may give it to anyone he wishes, he can keep the amount of Zakah himself provided that he is deserving of Zakah, otherwise not. It is stated in Durr-e-Mukhtar: It is permissible for the Wakeel to give Zakah to his Faqeer son or wife but he cannot keep it himself. However, if the Zakah-giving person states that the Wakeel may give it to any Masraf-e-Zakah he wishes, it is permissible for his own self as well provided that he is a Faqeer. (Durr-e-Mukhtar, vol. 3, pp. 224)

Paying Zakah in advance

How to Calculate Zakat- Zakah can be given in advance but following are its two conditions:

- The Zakah-giving person should be the owner of the Nisab

- The Nisab should be complete upon the completion of the year

If any of these two conditions is not fulfilled, the wealth given will be considered as Nafl-Sadaqah. (Fatawa-e-Hindiyyah, vol. 1, pp. 176)

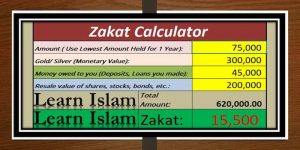

The method of making calculation in advance

Those Islamic brothers or Islamic sisters who own the Nisab and wish to give Zakah little by little in advance should make a rough estimation of the total Maal-e-Zakah (Wealth on which Zakah becomes Wajib)((gold, silver, currency notes, trade goods, etc.) they have. Then, as Zakah, separate 2.5% of the price of the total Maal-e-Zakah. Thereafter, the amount of Zakah should be divided by 12 if they wish to give it monthly, it should be divided by 48 if they wish to give weekly, and by 360 if they wish to give it daily. When the year completes, make the accurate and complete calculation of Zakah and give the remaining amount.

What should be done if the Zakah given in advance is more than the actual amount?

If the Zakah given in advance is more [than the amount which actually becomes Wajib upon the completion of the year], include the excess amount in the Zakah of the next year. (Fatawa-e-Hindiyyah, vol. 1, pp. 176)

What if the person to whom Zakah was given in advance becomes wealthy!

If the Faqeer to whom Zakah was given in advance becomes wealthy or dies or becomes a Murtad (apostate) upon the completion of the year, Zakah will be considered as paid. (Fatawa-e-Hindiyyah, vol. 1, pp. 176)

What if the Nisab no longer exists upon the completion of the year?

In such case, everything that is given will be considered as Nafl-Sadaqah. (Fatawa-e-Hindiyyah, vol. 1, pp. 176)

The payment of Zakah from the wealth of the Zakah-giving person

It is not necessary to give Zakah from the wealth of that person on whom Zakah is Wajib; someone else can also pay Zakah with his permission. (Fatawa-e-Razawiyyah, vol. 10, pp. 139) For example, if Zakah is Wajib on the wife, the husband can pay Zakah from his own wealth with her permission.

The ruling on giving someone’s Zakah from his wealth without permission If someone keeps on giving a person’s Zakah in advance from that person’s wealth without his permission and then informs him and he expresses his consent, even then, Zakah will not be considered as paid and this person should pay compensation for everything he has given to the Fuqara [poor people] without the permission of the owner. It is stated in Fatawa Shami: If someone pays [a person’s] Zakah without his permission, Zakah will not be considered as paid even if he expresses his consent when this news reaches him. (Radd-ul-Muhtar, vol. 3, pp. 223)

What if someone passes away without paying Zakah?

If a person upon whom Zakah is Wajib passes away, Zakah will stand remitted, i.e. it is not necessary to give Zakah from his wealth. However, if he has made a will, his “will” will be executed up to [a maximum of] one-third of his (total) wealth. If the Aaqil [sane] and Baligh ( Person who has reached puberty) inheritors give permission, Zakah should be paid from the entire wealth. (Bahar-e-Shari’at, vol. 1, Part. 5, Mas’ala No 84, pp. 892)

Giving Zakah conditionally

How to Calculate Zakat- If a person lays down any condition while giving Zakah such as, ‘I will give you if you live here later on, otherwise not’, or ‘I give you Zakah on the condition that you will spend it on such and such a purpose, for example, for the construction of a Masjid or Madrasah’, it is not necessary for the Zakah-taking person to abide by this condition. Zakah will be considered as paid because Zakah is Sadaqah and Sadaqah does not become Fasid [invalid] by a Shart-e- Fasid [invalid condition]. (Durr-e-Mukhtar Wa-Radd-ul-Muhtar, vol. 3, pp. 343)

What if someone invests the amount of Zakah in trade and distributes its profit amongst the poor?

If the year [of Zakah] has completed, it is Haraam to invest the amount of Zakah in trade instead of giving to the one who deserves it. However, if someone invests his amount of Zakah in trade before the completion of the year with the intention that he will give this amount along with its profit to Fuqara upon the completion of the year, then this intention is very good. (Fatawa-e-Razawiyyah, vol. 10, pp. 59)

Waqf from the amount of Zakah

Nothing can be made Waqf [dedicated] by purchasing it from the amount of Zakah because Waqf is not possible from the amount of Zakah, as Waqf does not lie under the ownership of anyone, whereas for paying Zakah, it is a condition to make someone its owner. Following is an alternative method for it that can be employed: Give Zakah to any Masraf-e-Zakah [Zakah-deserving person] and then he may purchase books, etc. and make them Waqf. (Fatawa-e-Razawiyyah, vol. 10, pp. 255)

Sending Zakah outside the city

How to Calculate Zakat- If a person wants to pay Zakah in advance, it is unconditionally permissible to send it to another city but if the year has completed, it is Makrooh to send it to another city. However, there is no harm if there is any relative, a needier person, a pious and ascetic person, or if sending it over there results in a greater benefit for Muslims. It is stated in Durr-e-Mukhtar: Transferring Zakah to another place is Makrooh. However, it is not Makrooh if there is any relative at another place, or a needier person, or a pious and ascetic person, or if it results in a greater benefit for the Muslims, or he wishes to give Zakah early before [completion of] the year. (Durr-e-Mukhtar Wa-Radd-ul-Muhtar, vol. 3, pp. 255)

Deduction of Zakah by the bank

When deduction of Zakah is made by the bank, conditions of the payment of Zakah are not fulfilled such as making [someone] the owner, as most of the amount is spent on such places where no one is the owner; therefore, Zakah will not be considered as paid. (Waqar-ul-Fatawa, vol. 2, pp. 414)

Therefore, cautiousness lies in paying Zakah according to Shari’ah by your own self.

A gift of cow meat

Umm-ul-Mu’mineen Sayyidatuna Aisha Siddiqah has narrated that cow meat was presented in the court of the Beloved Rasool Someone humbly said: ‘This meat was given as Sadaqah to Sayyidatuna Bareerah’ Rasoolullah ! responded: ‘i.e. This was Sadaqah for Bareerah, for us it is a gift. (Sahih Muslim, pp. 541, Hadees 1075)

Shar’i Heelah of Zakah

The cow meat received as Sadaqah by Sayyidatuna Bareerah Who was deserving of Sadaqah was undoubtedly Sadaqah for her. However, when this meat was presented in the blessed court of the Beloved Rasool ٖ after Sayyidatuna Bareerah had taken possession of it, its ruling had changed and now it was no longer Sadaqah. Similarly, after a Zakah-deserving person takes possession of Zakah, he can gift it to anyone or donate it for a Masjid or any Islamic organisation, as the amount that this person presents now is not Zakah but a kind of gift.

The method of Shar’i Heelah

Following is the method of Shar’i Heelah: Make any Shar’i Faqeer the owner of Zakah. Then he may give it (either on your advice or by his own self) for spending it on any virtuous cause. , both will earn Sawab [reward] in this way. The blessed Fuqaha [Islamic jurists] have stated: The amount of Zakah cannot be spent on ‘Tajheez and Takfeen [Islamic funeral rites]’ of the deceased or construction of a Masjid as [the condition of] making a Faqeer its owner is not fulfilled. If a person wants to spend on these purposes, the method is to make a Faqeer the owner (of the amount of Zakah); then he may spend it (on the construction of a Masjid and other such purposes); in this way both of them will get Sawab. (Radd-ul-Muhtar, vol. 3, pp. 343)

100 people earn equal Sawab

Dear Islamic brothers! Did you observe! Through Shar’i Heelah, Zakah can be used for shrouding, burial, and even for the construction of a Masjid because it was Zakah for the Faqeer; once he takes possession of it, he becomes its owner and may spend it in any way he wishes.

By the blessing of the Shar’i Heelah, the Zakah of the Zakah-giving person gets paid and the Faqeer also becomes deserving of Sawab by giving that amount for a Masjid. The details of Heelah should be explained to a Shar’i Faqeer. If possible, the amount should be passed on to many people while performing Heelah so that everyone earns Sawab.

For example, suppose 12 hundred thousand rupees of Zakah are given to a Shar’i Faqeer for performing Heelah. After taking possession of it, he should give it to any Islamic brother as a gift. Then, after taking possession of it, this second Islamic brother should also make someone else its owner.

In a similar way, everyone should keep on making the next person the owner with the intention of Sawab and the last person should give it for a Masjid or other purpose for which Heelah was performed. , everyone will earn Sawab of giving twelve hundred thousand rupees as Sadaqah. Sayyiduna Abu Hurayrah has narrated that the Beloved Rasool said:

If Sadaqah has passed through a hundred hands, everyone will earn the same Sawab as the Sadaqah-giving person and there will not be any reduction in his reward. (Tareekh-e-Baghdad, vol. 7, pp. 135)

What if a Shar’i Faqeer does not return Zakah after taking it?

If Zakah is given to a Shar’i Faqeer for performing Heelah and he takes it and keeps it with him, it cannot be taken from him forcefully to spend on virtuous causes because now he has become its owner and he has the right over his wealth. (Fatawa-e-Razawiyyah, vol. 10, pp. 108)

What if one cannot find a trustworthy person for Shar’i Heelah?

If one cannot find any trustworthy person, following is an alternative possible method for it: If the calculated amount of Zakah is five thousand rupees, sell anything such as a few kilograms of wheat to a Shar’i Faqeer for five thousand rupees.

Explain to him that he will not have to pay its price; in fact, you will give him the amount which he will use to pay the price. When he accepts the Baiy [offer], wheat should be given to him. In this way, he will owe you five thousand rupees.

Then give him five thousand rupees as Zakah and once he takes possession of it, Zakah will get paid. Thereafter, take those five thousand rupees back as the price of wheat. If he refuses to return the amount, it can be taken even forcefully as Dayn can be taken back even forcefully. (Durr-e-Mukhtar, vol. 3, pp. 226, Fatawa-e-Amjadiyyah, vol. 1, pp. 388)

Advising a Faqeer to spend the amount of Zakah on virtuous causes

After giving the amount for Shar’i Heelah, you can advise a Faqeer to give it for any virtuous cause. , both will earn Sawab for it as the person who guides [someone] to goodness, he also receives the Sawab of that person who acts upon it. (Radd-ul-Muhtar, vol. 3, pp. 227, Fatawa-e-Amjadiyyah, vol. 1, pp. 388)

What if someone has spent the amount of Zakah on a Madrasah without performing Shar’i Heelah?

If someone has spent the amount of Zakah on a Madrasah without performing Shar’i Heelah, that spending cannot be included in Zakah now because the conditions of payment [of Zakah] have not been fulfilled. Whatever has been spent will be considered to be from the person who has spent it. It is compulsory for him to pay compensation for that total amount (i.e. he should pay that amount out of his own pocket). (Fatawa-e-Faqih-e-Millat, vol. 1, pp. 311)

Performing Shar’i Heelah in order to give Zakah to one’s parents

If one’s parents are needy and the person wishes to give them Zakah after performing Heelah such that he gives it to a Faqeer who then gives it to them; it is Makrooh [disliked act]. Likewise, it is also Makrooh to give to one’s own children after performing Heelah. (Bahar-e-Shari’at, vol. 1, Part. 5, Mas’ala 24, pp. 928)

Giving Nafl-Sadaqah instead of Zakah

Following is the summary of the answer given by A’la Hadrat Imam Ahmad Raza Khan on page 175, volume 10 of Fatawa Razawiyyah in reply to a question: Who is more foolish than the one who spends his wealth sincerely or insincerely on charity and keeps carrying on his shoulders the Fard owed to Allah and that heavy debt owed to Allah , the Most Dominant, the Most Supreme.

It is a great satanic deception that he causes destruction to a person under the guise of performing virtuous deeds. A stupid person does not become aware [of this trick]. He thinks that he is performing a virtuous deed and does not realise that Nafl without Fard is only a hidden deception. There is no hope of its[i.e. Nafl’s] acceptance, and the torment for missing that [Fard act] remains on his shoulders. Dear brother! Fard is a debt specifically owed to Allah and Nafl is like a gift.

A will made by Ameer-ul-Mu’mineen Sayyiduna Abu Bakar

When the time came of the demise of Sayyiduna Siddeeq-e-Akbar ” Khalifah of Rasoolullah he called Ameer-ul-Mu’mineen Sayyiduna Farooq-e-A’zam and said: O Umar! Keep fearing Allah! Remember that there are some obligations owed to Allah in the daytime such that He will not accept them if performed in the night, and some obligations [are owed to Him] in the night such that they will not be accepted if performed in the daytime. Beware, any Nafl is not accepted until Fard is performed. (Hilyat-ul-Awliya, vol. 1, pp. 71)

The Warning of Ghaus-ul-A’zam

Ghaus-e-A’zam Sayyiduna Shaykh Abu Muhammad Abdul Qaadir Jeelani has stated great heart-stopping examples in his excellent book ‘Futooh-ul-Ghayb’ for the one who performs Nafl, leaving Fard. He has stated: The example of such person is similar to the one who is called by a king for service; he does not go over there and keeps serving the slave of the king.

Then, he has narrated its example from Ameer-ul-Mu’mineen

Sayyiduna Ali Murtada that he said: ‘The state of such person is like a woman who remained pregnant but had a miscarriage when the time of childbirth came close. Then, she neither remained pregnant nor gave birth to a child.’ It means if a woman suffers a miscarriage after a full-term pregnancy, she experiences all the difficulties of pregnancy, but in vain. If a child was born, the fruit [of experiencing these difficulties] would be present; if she had still remained pregnant, there would be hope in the future. Now, there is neither pregnancy nor a child, neither hope nor a fruit [of experiencing difficulties] but such woman experiences the same difficulties as experienced by the woman who actually gives birth to a child. Similarly, this person who gives Nafl charity donates money but since he has missed a Fard act, this Nafl is not accepted as well; so he gives money, but in vain.

In the same blessed book, it is narrated from.e. If a person performs Sunnah and Nafl after leaving Fard, these will not be accepted and he will be humiliated. (Sharah Futooh-ul-Ghayb, pp. 511- 514) In of the blessed book Awarif, Imam Shahab-ud- Deen Suharwardi has narrated from Sayyiduna Khawwaas ’ i.e. We have received information that Allah does not accept any Nafl until Fard act is performed. Allah says to such people: Your example is like a bad servant who presents gift before paying debt. (‘Awarif-ul-Ma’arif, pp. 191)

Performing three Fard acts out of four

It is stated in a blessed Hadees, the Beloved Rasool has said:

. I.e. Allah has made four things Fard in Islam. The person who performs three out of them, they will not bring him any benefit until he performs all four, Salah, Zakah, Sawm [fasts] of Ramadan, and Hajj-e-Ka’bah. (Musnad Imam Ahmad, vol. 6, pp. 236)

Salah is not accepted

Sayyiduna Abdullah Bin Mas’ood ” has stated: ‘I.e. We have been ordered to offer Salah and give Zakah, and Salah of the one who does not give Zakah is not accepted. (Al-Mu’jam-ul-Kabeer, vol. 10, pp. 103, Hadees 10095)

! When even the Salah, Sawm, and Hajj of the person who withholds Zakah are not accepted, what can one hope for any type of Nafl charity? In fact, Isbahani has narrated from Sayyiduna Abdullah Bin Mas’oo.e. The one who offers Salah but does not give Zakah is not that Muslim whose deeds benefit him. (Az-Zawajir, vol. 1, pp. 280) Ya Allah ! Guide the Muslims. Ameen

The ruling on whatever has been given as Sadaqah and charity!

All that a person has given as charity to date, constructed a Masjid, made a village Waqf [dedicated], these all have become valid and definitive as neither can he now take the amount of charity back from the Faqeer that he has given, nor does he has the authority to cancel the Waqf he has made, nor can he spend the income from that village for paying Zakah or on his personal or any other purpose, as after completion, Waqf becomes definitive and permanent and one has no authority to cancel it.

However, despite this fact, there is no hope of Sawab [reward] and acceptance for these acts until a person pays the complete amount of Zakah, as for any act, becoming valid is something else, and being accepted and receiving Sawab for it is something else. For example, if a person offers Salah out of pretentiousness, the Salah will be valid and the Fard [obligation] will stand discharged, but neither will it be accepted nor will he earn Sawab; instead, he will become a sinner. Similar is the example of that person.

Recognise the satanic attack

Dear brother! For causing complete destruction and stopping a person from giving even this charity which is benefiting the poor people, the cursed Satan who is the open enemy of a person will then instil such thoughts: ‘What is the benefit of giving such charity which will not get accepted. Stop giving it as well, and obey me completely.’

However, Allah wills to grant you peace and safety, and salvation from severe torment. Allah will enlighten your heart with such thoughts: ‘The response to this Shar’i ruling is not the one which this enemy of Iman has taught you, and made you completely disobedient and nonobservant.

Instead, you should have worried, due to which you would have attained salvation from the Divine punishment and also, you could hope for your Waqf, [contribution to] Masjid and charity to date, all being accepted.’

Just ponder! Is it better that one’s vain attempts made in the past become beneficial and the efforts which were being wasted, actually bear fruit or is it better to abandon doing even those deeds of obedience which a person was doing before and as a result, become amongst the disobedient and nonobservant people! The best advice is: Repent for withholding Zakah.

Pay Zakah

Pay the complete amount of Zakah you have withheld to date, immediately and wholeheartedly for pleasing your Rab and obeying Him so that in the court of Allah , your name is erased from the list of disobedient servants and written in the list of the obedient ones.

Also, so that you find hope of becoming successful in the court of Allah , the most Gracious, Who has blessed you with life, body, wealth, countless blessings; and good news is that once you give Zakah, there will be a hope that all that you have given as charity to date, made Waqf, donated for the construction of a Masjid, etc. will also be accepted as, when the crime due to which all these deeds were not acceptable doesn’t exist anymore, , these deeds will also be accepted.

The method of calculating Zakah

Following is the best advice; however, every individual has the choice between the right and wrong path. If the exact calculation of Zakah cannot be made as a long time period has elapsed, for the betterment of one’s afterlife, think and assume the maximum possible amount, as the excess amount will not get wasted but will be in the Divine treasure for your help in your hour of need. Allah will bless you with its perfect reward which you cannot even imagine. If you pay a lesser amount, remember, the demand for fulfilling the obligation owed to Allah is equal, be it one rupee or a thousand.

It is our own mistake!

The Nafs [inner self] may find it difficult and painful to give a huge amount of Zakah of several years. Firstly, consider the fact that it is your own mistake. If you kept giving it on a yearly basis, it would not become a huge amount. Moreover, take a look at the mercy of Allah .

He did not order us to give it only to the people other than one’s relatives. Instead, there is double reward for giving it to one’s relatives; one for giving charity and the other for being kind to the relatives. Therefore, give it to the relatives who are close to your heart such as the brother and nephew, as you will not feel much burden by giving it to them.

Just keep it in mind that they should neither be Ghani nor Na-Baligh (Child who has not yet reached puberty) children of a living Ghani person, nor should they be your lineal ascendants or lineal descendants. Then, if it is such a huge amount that nothing will be left from your wealth afterwards, it still needs to be given in order to attain salvation. One can, somehow or other, live this short life but it is extremely difficult to suffer severe Divine torment for thousands of years.

Heelah for the payment of Zakah of several years

If a Zakah-giving person gives the possession of the amount of money to his relatives with the intention of Zakah and then out of pity, they willingly return as much as they wish as a gift without being forced by him, it is completely beneficial for all. The benefits for the Zakah-giving person are that he attains salvation from Divine torment, the debt and obligation he owed to Allah is paid, he receives the amount back after it becomes Halal and pure, and the rest of the amount remains with his beloved relatives.

The benefits for the relatives are that they receive wealth in this world and attain Sawab in the Hereafter for feeling pity for their beloved Muslim brother, giving that amount to him as a gift and helping him in paying his Zakah.

If a person can completely trust them, there is no need to calculate the Zakah of all the years. He may give them his entire wealth as Tasadduq [charity] placing it in their possession. Then, they may give him as a gift as much as they wish. In this way, his complete amount of Zakah gets paid, all purposes are fulfilled, and the Zakah-giving person and Zakah-taking person both receive every type of religious and worldly benefit. May Allah grant us Taufeeq [desire and determination] by His mercy to act upon the Islamic teachings.

Give Zakah happily and wholeheartedly

How to Calculate Zakat- Sayyiduna Abu Dardah “has narrated that the Beloved Rasool said: The one who has performed these five acts with Iman [faith] will enter Jannah: He who has punctually offered the five [daily] Salahs with their Wudu, Ruku’, Sujood and timings, observed Sawms [the fasts] of Ramadan, he who has performed Hajj when it became affordable [for him], paid Zakah happily and wholeheartedly, and returned Amanah [trust]. (Majma’-uz-Zawaid, vol. 1, pp. 205, Raqm 139)

Sayyiduna Abdullah Bin Mu’awiyyah Al-Ghadiri has narrated that the Beloved Rasool said, ‘the one who has performed three acts, has had the taste of Iman:

- He who has worshipped Allah alone and has had the belief that there is none worthy of worship except Allah .

- He who has paid Zakah of his wealth every year happily and wholeheartedly.

- He who has given Maal [wealth] of an average standard as Zakah, instead of aged and sick animals or ragged clothes and wealth of a poor standard, because Allah neither demands your wealth of the highest standard from you nor does He give permission to give the wealth of a poor standard. (Abu Dawood, vol. 2, pp. 147, Raqm 1582)

![How many the payment of Zakah ? zakat calculator, zakat rules,who is eligible for zakat,sadaqah, definition of charitycharity water, and quranmualim. Learn Quran, Quran translation, Quran mp3,quran explorer, Quran download, Quran translation in Urdu English to Arabic, Al Mualim, Quranmualim, Vislam pictures, Islam symbol, Shia Islam, Sunni Islam, Islam facts],Islam beliefs and practices Islam religion history, Islam guide, prophet Muhammad quotes, prophet Muhammad biography, Prophet Muhammad family tree.](https://www.quranmualim.com/wp-content/uploads/2019/06/Write-about-the-payment-of-Zakah-C-e1626533177801.png)

Our Android Apps

About CEO Al-Asad Online

Hafiz Abdul Hameed

Master In Islamic Studies

(Tajweed, Waqf)

Web Developer/Administrator

Web Content Writer

Blogger, SEO Expert

Graphic Designer

WhatsApp: +92 301736500