Are Bonds Haram – Bonds are, in fact, considered as haram. According to Islamic experts, the selling, buying or trading of premium bonds in the context of business is considered to be haram.

Are bonds haram? This question has been debated by many within the financial industry. Bonds are basically loans given by institutions or individuals to government agencies or corporations and are characterized by the payment of interest over time.

The issue stems from issue that Islamic law prohibits the investment of any type of activity that involves usury or riba, that includes interest. If a bond is paying interest, would this render it illegal?

Table of Contents

- What is Haram?

- What Are Bonds?

- Types of Bonds

- Advantages of Investing in Bonds:

- Disadvantages of Investing in Bonds:

- Are Bonds Haram in Islam?

- List of Halal Bonds

- FAQ

- Are all bonds haram?

- What is the alternative to bonding for Islamic investors?

- How do I know whether a bond is haram or Halal?

- Conclusion

What is Haram?

Haram finance refers to a kind of financial transaction that is believed to be against the principles of Islam. This could include things like Usury (charging interest) as well as gambling and speculation.

Although there is some debate among academics about what exactly constitutes haram in finance The general consensus is that any type of activity that is risky or involves speculation, or that causes the exploitation of other people, is not permitted.

There are numerous reasons that haram finance is not permitted in Islam. In the first place, it is viewed as a violation to the ideals in fair trading and equitable which is the core of Islamic principles.

In addition the practice of engaging in haram can cause difficulties and financial stress as well as hardship for the individual as well as the community at large. In addition, haram finance is frequently viewed as an act of exploitation since it is typically a benefit for people who already have a lot of money and at the expense of those less fortunate.

There is a lot of disagreement about what constitutes and doesn’t constitute Haram finance however, there are certain actions that are considered as prohibited. This includes:

(charging interest): (charging an interest): Islam teaches that money should be used only for productive purposes which is why charging interest can be a type of exploiting.

Gambling: Gaming is considered as an expression of speculation which is a sin in Islam. Additionally, it can result in financial instability and even hardship.

The Islamic teaching is that money should only be used to achieve productive goals which is why speculation could be considered a type of gambling that could result in financial difficulties and instability.

Exploitation: Any act that causes the exploitation of another in any way, either financial or other is against the rules of Islam. This includes actions such as child labour, slavery and usury.

What Are Bonds?

Bonds are a good option to diversify your portfolio and earn a steady stream of income. When you purchase bonds, you loan money to the institution that issued the bond or to the government in exchange for regular payments (usually every two years) and the repayment of the principal at the date of maturity.

Bonds are a reliable source of income, if they are they are held until maturity and are available in a variety of varieties. The government bonds are thought to be to be the safest investment since the government is usually capable of repaying its debts, whereas corporate bonds have higher risk, however they also provide higher returns.

Municipal bonds, also known as municipal bonds come from local authorities and may offer tax benefits for investors based on their residence state. Bonds come in a variety of sizes and shapes, so it’s crucial to understand which kind of bond is best suited to your goals for investment. With just a bit of research and guidance from experts in finance, you will be able to discover the perfect bond to suit your needs.

Bonds possess unique qualities which make them a desirable choice for investors who want to diversify their portfolios. They usually have lower risks than stocks and, because they are fixed-income instruments it is possible to know precisely the amount of return you will earn on your investment is going to be.

Bonds are also less volatile on the market because they are designed to provide a steady income stream, which makes the perfect investment for those seeking long-term, steady returns. Additionally, bonds could offer tax benefits based on the nature of the bond along with your specific tax circumstances. If you are aware of the proper investment strategy, bonds could make a significant part of a diverse portfolio.

Types of Bonds

Bonds are an excellent choice for investors, both people and institutions who want for a way to broaden their portfolios and generate an income stream that is steady. Did you know there are numerous types of bonds you can choose from? Knowing the various types of bonds will assist you in making educated choices in your investment and help you reach your financial objectives.

Treasury Bonds: These bonds are issued by either local or national government bodies and are thought as low-risk investments. They provide a safe source of income, and are frequently used as a standard for other kinds of bonds.

Corporate Bonds Corporate bonds originate from corporations and provide greater returns than those of government bonds. They are regarded as slightly more risky than bonds issued by governments, however they are still able to provide an ongoing stream of income.

Municipal bonds: Municipal bonds can be issued by local authorities including cities and counties. They are used to fund public projects. They typically are tax-free, which makes them a good choice for those who are in tax-high brackets.

High Yield Bonds: Also referred to as junk bonds. High-yield bonds provide greater yields than other kinds of bonds, however they come with a higher degree of risk. These bonds are offered by firms that have lower credit ratings, and are suited to those with a greater risk tolerance.

floating rate bonds Floating rate bond have an adjustable rate of interest that alters based upon an interest rate benchmark. The idea behind them is to safeguard investors from the rising interest rate and provide an income source that is flexible.

Zero Coupon Bonds These bonds do not have a periodic interest rate they are offered at a price that is lower in comparison to their actual value. They are a long-term investment which offer a single installment at the time of maturity.

Advantages of Investing in Bonds:

Income that is predictable: They provide reliable source of income through interest payments, which makes them a popular choice for those who are looking for steady income.

Diversification They can assist in diversifying your investment portfolio while decreasing the risk you face overall.

Security: Bonds issued by government agencies and established businesses are considered to be low risk investments, which makes them a secure investment for a lot of investors.

Disadvantages of Investing in Bonds:

Limits the potential for growth: Bonds generally offer less than other kinds of investments, like stocks.

Risk of interest rates: Changes in interest rates can affect how bonds are valued, which makes them an investment that is less reliable choice.

Credit Risk: Bonds issued by government or corporations with less credit ratings are deemed to be at a higher risk and carry the possibility of default.

Are Bonds Haram in Islam?

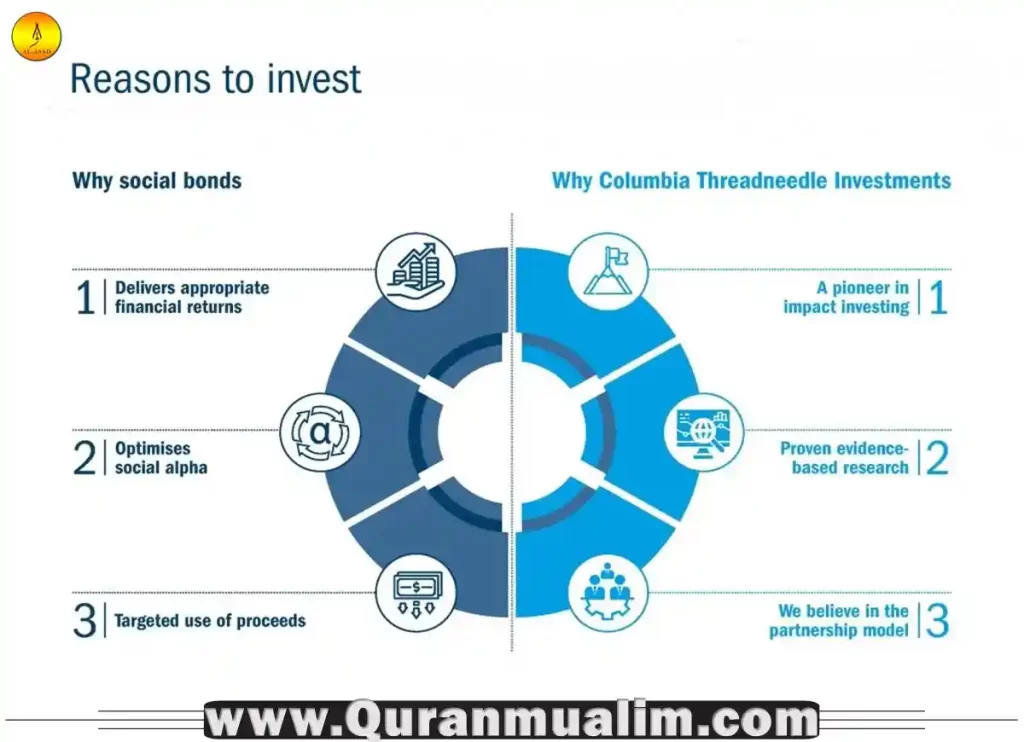

The investment in bonds is an increasingly popular option for investors to earn money however for Muslims this is a difficult choice. They are usually thought of as safe investments, however what people aren’t aware of is that investing into certain kinds of bonds may be prohibited by Islamic laws.

What does this mean? Are all bonds haram, or just certain kinds? In order to answer that question, you need to comprehend what makes bonds Haram according to Islamic law.

The most crucial aspect to consider is whether or not the security promises to pay interest on top to the value of the bond. This kind of arrangement is referred to as “usury,” and is not permitted under Sharia law, as the interest rate is deemed to be haram. Bonds with conditions included, like conditions on benefits, can be a violation as well.

Thus it is important for Muslims it is crucial to determine if bonds are usury-based or not prior to making an investment in it. Numerous financial institutions provide Islamic bonds that are in line with Sharia law, so this is something to consider when you want for bonds to purchase from an Islamic view.

Source Reference: The information above can be verified using Islam question and answer.

List of Halal Bonds

Here is a list of kinds of bonds that are halal for Islam:

Asset-Backed Sukuk This kind of sukuk relies on the ownership of tangible assets like commodities, real estate as well as infrastructure or construction projects. Investors are paid a percentage of the earnings made by the assets.

Isisna’a Sukuk: These are used to fund a particular deal or project. The issuer uses funds to pay for the production or construction of the asset in question and investors will get part of the earnings from the asset.

Murabaha Sukuk The sukuk are built on the idea of Murabaha which is the sale and purchase of products at a price that is marked up. The issuer buys goods using the proceeds of the sukuk and sells them back to investors at a greater cost. Investors are paid a percentage of the proceeds generated by the sales of the items.

Musharakah Sukuk: This type of sukuk entails sharing ownership of an asset or project, where investors share in the losses and profits. This type of structure is compatible with Islamic principles of risk sharing and encourages investing in real economic activity.

Wakala Sukuk: These are investment certificates which represent ownership in a pool assets overseen by trustees. The trustee is accountable to invest the assets and disbursing the profits to investors.

In general, halal bonds also known as sukuk, are crafted to conform to Islamic principles and are free of the use of interest-based transactions. They allow Islamic investors to take part in the world’s financial markets and still adhere to their religious tenets.

Alternatives for Bonds in Islam

If you’re trying to figure out how to earn returns on dividends, or even passive profits from investing in the correct way, we’ve got all the info you require.

There are many options for Halal fixed-income solutions. Below are a few alternatives that are free of interest and compatible with Islamic religion.

Sukuk

Sukuks are a type of bonds which are considered to be halal.

They are often called Islamic bonds. They are different from conventional bonds in order to conform in accordance with Sharia rules and Islamic rules.

Contrary to traditional bond, Sukuks don’t have debt repayment. Instead, each owner receives an asset and the earnings from these assets are paid back to the individual who purchased them.

The profits result from Sukuks smoothing the irregular revenue generated by the property. This income is offered as a benefit to bond holders and transforms them into regular dividends.

If there aren’t any revenues then there will be no profits. Thus, Sukuk does not work on interest. Instead, it’s based on the notion of ownership, profit, and revenue, which are completely permissible.

It’s like buying stocks, however instead of being a shareholder of the business it is a stake in the assets of a business like equipment, which can be used later to generate profit.

How can you invest in retirement or for college

Bonds, stocks and mutual funds are different types of funds that can be invested in various types of accounts like retirement plans as well as an education savings plan.

A lot of American Muslims think that 401(k) plans are investments however they’re notthey’re tax-advantaged funds that contain investments. This is the same with IRAs, 403(b) plans 529 plans, Coverdell education savings Accounts. You decide which investments to place into these accounts.

| The type of investment | Is it a thing? | Could it be considered halal? |

| Stocks | Ownership shares of a business | Yes. It is recommended to screen stocks for business lines as well as financial ratios and other aspects. Even stocks that are considered halal can be subject to purification charges. |

| Bonds | Shares of ownership in debt | Traditional bonds: Nothey are made up of the borrowing and lending of interest. Additionally the trading of debt is not legal. An alternative that is halal is the sukuk (some people refer to them as “Islamic bonds”). |

| Hedge funds | A private investment partnership | No. hedge funds depend on borrowing money and often employ high-risk activities. They typically deal with derivatives and short-selling (not Halal as it’s selling something that you do not own) as well as margins (not inhalal as it requires borrowing interest). |

| Options | Contracts that allow investors the ability to purchase the asset for an agreed price prior to an agreed upon date. The investor isn’t required to purchase or sell the asset however, they must pay a non-refundable cost to purchase the option. | Generally, no. Options are speculative in their nature. They are a type of investment right that is not an actual asset. However, buying stock options from the company you are employed by is considered to be to be halal. Trading these options could be difficult. |

| Currencies | An accepted currency. Examples: dollar, euro. | No. The majority of currencies are bought through options. For them to be considered legally halal, their transactions will need to be completed immediately and not deferred like options. Gold and currencies are considered as money assets (pricing instruments). |

Common investments accounts to save for retirement

- IRA (traditional or Roth other) generally set up and managed by individuals

- 401(k) plan usually designed and administered by a company

- 403(b) plan typically, it is managed and established by a school, hospital or university, or a non-profit

- TSP (Thrift Savings Plan) -Retirement plan for federal employees.

Common account for investment in education savings.

- 529 plans are run by states; always includes investments with interest

- Coverdell Education Savings Account

- UGMA/UTMA (Uniform Transfer of Minors Act) custodial accounts

FAQ

Are all bonds haram?

This question isn’t straightforward and depends on each your personal interpretation as well as the specific characteristics of every bond. Some believe that bonds are illegal if they contain interest, whereas others believe the bonds could be arranged in a manner that is in line with Islamic laws.

What are options to bonds that are available to Islamic investors?

If you are looking for a way to make investments in a manner that is in line with Islamic laws There are alternative options to bonds, like the sukuk, which is structured as investments backed by assets, not loans. There are also equity investments in sharia-compliant businesses as well as investments in real property.

How do I know whether a bond is haram or Halal?

It is important to take a close look at the conditions and terms that apply to any bonds investment and also seek advice from a reliable financial advisor as well as an Islamic scholar. The factors to be considered include the amount of money invested and the type of interest that is involved, as well as the risk level that comes with the investment.

Conclusion

It is crucial to comprehend the complexities involved in the investment on bond securities from an Islamic standpoint. Although some bonds are not considered prohibited from being haram, there are a few varieties that might be in violation of Islamic laws and principles.

Therefore, it is essential to examine each bond thoroughly and the underlying principles behind it prior to making a decision to invest.

This is a process that requires a lot of research and an knowledge about Islamic financial and rules. Armed with this information, Muslims can invest in bonds in a way that is compatible with their beliefs and values and ensure that they are not in violation of Islamic laws. When they carefully consider the features of bonds, Muslims can make informed investments that are able to keep in mind spiritual and financial values.

Click Here To Find Out:

- Are Fake Nails Haram?

- Is It Haram to Dye Your Hair?

- Are Lip Fillers Haram in Islam?

- Is CBD Halal? Quick Guide 2023

- Why Are Lash Extensions Haram?

- Are Anklets Haram? Updates 2023

- Are Hair Extensions Haram in Islam?

- Are Zodiac Signs Haram? Quick Facts

- Is Botox Haram In Islam? Quick Guide

- Best Halal Nail Polish Collections 2023

- Do Muslim Women Shave? Quick Facts

- Are Nose Jobs Haram? Quick Facts 2023

- Are Tampons Haram in Islam? Facts 2023

Written By Hafiz Abdul Hameed

Hafiz has been an Islamic scholar Author, writer and External Consultant for Renewable Energy Maldives. He writes about Islamic financial matters, food, and halal diet guidelines.

He is a well-known voice within his Muslim community, and is renowned for his straightforward explanations of complicated religious concepts. The scholar has also been asked to address numerous seminars and conferences about topics relevant to Islamic finance food, and renewable Energy.